Direct Indexing: How It Works, Benefits, and Drawbacks

Discover the benefits of direct indexing for personalized investing and tax efficiency while also considering its challenges.

Direct indexing is an increasingly popular investment strategy that bypasses traditional investing in mutual funds or exchange-traded funds (ETFs) in favor of investing directly in individual stocks within a given index, such as the S&P 500. This unlocks tax-loss harvesting from underlying stocks which decline in value, often resulting in the ability to recognize significant tax savings while tracking the same total return as the broader market.

According to Cerulli Associates, direct indexing is projected to grow faster than ETFs, mutual funds, and SMAs, reaching $800 billion in assets by 2026.

Direct indexing is not a new concept. However, it has recently become less expensive and more accessible to individual investors with smaller asset bases. Recent technological advancements—such as fractional shares, zero commission trading, and lower compute costs—have enabled cost-effective automation. This has enabled a new crop of direct-to-consumer platforms that offer direct indexing for portfolios at much lower minimums, without the need to purchase through a wealth manager¹.

¹The only known direct indexes for retail investors that don’t not require a human financial adviser are Wealthfront (minimum $100,000 and .25% fee), and Fidelity (minimum $5,000 and .40% fee).

What is Direct Indexing?

Traditionally, the best way to get the performance of an index has been to buy an ETF. Direct index investing offers an alternative: purchasing many or all of the individual stocks that make up the index. It is more complex, but it also opens the door to benefits that traditional index investing cannot provide.

The primary attractions of direct indexing are:

Tax-loss harvesting at scale: There is no way to sell only those individual stocks within an ETF that have declined; investors must either sell or keep the entire basket. Traditional ETF-to-ETF tax loss harvesting strategies provide some benefit but are less granular then security-level tax loss harvesting. Therefore, they tend to only capture about half as much of the potential tax savings.

Diversification of concentrated positions: For investors with a substantial portion of their wealth in a single stock—such as startup employees and entrepreneurs—direct indexing offers a pathway to systematic diversification. The tax losses it provides can be used to offset much of the taxable gain from selling concentrated appreciated positions. Direct index tax losses can be used equally to offset gains outside of public equities, such as the sale of appreciated real estate, or private companies.

Customization: ETFs and mutual funds represent a basket of stocks. This basket is selected by the ETF as a whole, rather than by each individual investor. Therefore, investors cannot choose to exclude certain companies they may want to avoid, such as the stock of an employer to which they are already over-allocated. With direct indexing, each investor can select unique and precise parameters on the stocks they want to include or exclude from their portfolio.

Despite the advantages of direct indexing, these portfolios can be complex to manage since they can involve hundreds of positions and frequent trading. For self-directed investors, the effort required to continually balance index tracking risk with tax optimization is likely too time-consuming and complex to justify the advantages. However, modern platforms can automate the process, making direct indexing realistic to a broader range of investors.

How Does Direct Indexing Work? What is Tax Loss Harvesting?

The core strategy behind direct indexing is tax-loss harvesting.

When an investor sells a stock for less than they paid to buy it, they generate a loss they can report on their tax return. These losses can be used to offset taxable gains on other securities, as well as up to $3,000² per year of ordinary income. Identifying assets which have declined in value and triggering the recognition of those losses is the essence of tax loss harvesting.

Direct indexing allows tax-loss harvesting at scale while minimizing tracking error against an index. In a large portfolio of hundreds of stocks, some securities are very likely to have declined in value. In order to reap the tax gains from these declines, the investor must sell the particular stocks that have declined in value. To keep returns in line with the desired benchmark (e.g., the S&P 500), the investor must use the proceeds of that sale to purchase different (but highly correlated) stocks. For example, an investor could sell shares of Exxon to recognize a loss and simultaneously buy shares in Chevron to maintain constant exposure to the energy industry.

After a 30-day period, the investor may repurchase the original stock without triggering a “wash sale,” which would have disqualified the loss. Doing so enables investors to achieve market returns with minimal tracking errors while generating tax losses that can offset current and future capital gains. This approach can be particularly advantageous for high-income individuals or those in high-tax jurisdictions.

²$1500 per person if married and filing separately.

By tax loss harvesting, an investor swaps out a losing stock for 30 days for a basket of similar stocks. Once the 30 day window has passed, the original stock is repurchased. This allows the investor, in this case, to harvest $6,000 in tax losses while maintaining minimal tracking error.

Compared to an ETF, the total returns are similar. Both a direct index and an ETF will own hundreds of companies across many sectors of the economy. In either case, an investor gets the economic benefit of owning each of these stocks. With an ETF, however, the investor does not have the option to buy and sell particular stocks within that fund—they can only buy and sell pieces of the entire ETF. With direct indexing, investors own each individual stock at an atomic level. If any of the 503 stocks of the S&P 500 are at a loss on a particular day, therefore, the investor may trade them to recognize tax losses.

Many robo-advisor platforms leverage ETF-to-ETF tax-loss harvesting while simultaneously tracking a major index. This is done by swapping between similarly-performing ETFs during market downturns. There are two main drawbacks to this approach.

First, swapping between ETFs presents limited tax-loss harvesting opportunities since the universe of ETFs tracking the same index is finite. Expanding outside this pool often results in higher tracking errors (for example, an investor may end with a substantial investment into a Russell 3000 ETF despite aiming to track the S&P 500).

Second, because these assets generally reflect broad market performance, they don’t allow for loss harvesting at the individual stock level. During a bull market, there is little opportunity for ETF-to-ETF losses, even if dozens of individual companies have suffered significant price declines.

6 Benefits of Direct Indexing

Based on research from Frec of direct indexing the S&P 500, investors can aim to harvest nearly 40%³ of their initial investment value in the form of tax losses over ten years, assuming typical market conditions.

³“40% tax losses harvested from a portfolio” is based on a ten-year time frame and simulation results from Frec's direct index model tracking the S&P 500 index. The results are hypothetical, do not reflect actual investment results, and are not a guarantee of future results. The simulations were run to tax loss harvest on a weekly basis in a ten-year time frame of ninety-day increments from 12/17/2003 - 06/10/2022 with a $50,000 initial deposit. The simulations averaged at the end of year ten resulted in a 40% accumulated tax loss savings and does not include Frec's 0.10% fee.

In addition to tax-loss harvesting, direct indexing offers several other benefits:

Customization: Investors can tailor index exposure to align with their personal values, risk tolerance, or specific investment theses by adding or subtracting stocks and sectors.

Diversifying concentrated stock: Direct indexing provides a tax-efficient way to gradually reduce large positions in a single stock—often a concern for founders and entrepreneurs with significant equity in a single company.

Greater control over index holdings and dividend control: Investors have the flexibility to manage individual stock positions and dividend reinvestment strategies according to their specific needs.

Visibility into underlying trades: Assuming the platform provider offers this transparency, direct indexing can offer full visibility into the portfolio's composition and trades on a daily basis.

Low fees: Direct indexing involves only a single fee layer (as low as 0.10%⁴ for new platforms like Frec), with no wealth management fees or mutual fund charges like sales loads, admin fees, or marketing fees.

⁴ Frec's direct indexing annual aum fee depends on the index strategy and ranges from 0.10% - 0.35%. Frec also has other fees, such as regulatory, outgoing wires, and outgoing ACATS fees. See all of them at https://docs.frec.com/pricing-fee-schedule.pdf.

Why is Direct Indexing More Tax Efficient?

Direct indexing's tax efficiency stems from its granular approach to portfolio management. Unlike ETFs or mutual funds—which are treated as single entities for tax purposes—direct indexing allows for tax optimization at the individual security level.

Generally speaking, simply harvesting losses for a given portfolio involves some bookkeeping but is not particularly challenging for a software application. However, weighing the tradeoff between deviating from the target index allocations and harvesting losses and deciding how to strategically reinvest any sale proceeds is much more complex.

This granularity provides several key tax advantages:

Automatic tax-loss harvesting: In a diversified portfolio, some stocks will inevitably underperform while others outperform. Direct indexing allows investors to selectively realize losses on underperforming stocks while maintaining gains on winners.

Wash sale rule management: Sophisticated direct indexing algorithms can navigate the complexities of wash sale rules (which forbid the selling and then immediate repurchasing of a stock) more effectively than manual trading. They can substitute similar securities to maintain market exposure while still capturing tax losses.

Year-round loss harvesting: Unlike many investors (or advisors) who only consider tax-loss harvesting occasionally—due to its labor-intensive nature—direct indexing platforms continuously monitor for loss harvesting opportunities throughout the year, potentially capturing more tax alpha.

Customized tax management: Direct indexing allows for tailored tax strategies based on each investor's specific situation. For instance, it can prioritize short-term or long-term losses depending on your other income and capital gains for the year.

These factors combine to create a more tax-efficient investment approach, potentially leading to higher after-tax returns than you could achieve by simply investing in an ETF. It is, however, important to note that the size of each investor’s tax benefits will vary based on factors such as portfolio size, market conditions, and individual tax circumstances.

Direct Indexing vs. Other Investment Approaches

Direct indexing can be combined with a variety of investing strategies, such as a focus on particular sectors of the economy, and it can be executed individually or in partnership with a wealth manager.

Below is a description of how direct indexing interacts with and compares to other investing strategies:

Direct Indexing vs. ETFs

Direct indexing aims to achieve similar pre-tax returns as an ETF or index fund (often a broad market fund, like SPY) while also unlocking tax benefits by tax-loss harvesting the individual stocks within those indexes. Investors who are interested in investing through ETFs or index funds will likely find direct indexing most attractive, as it definitionally involves mirroring an existing stock index.

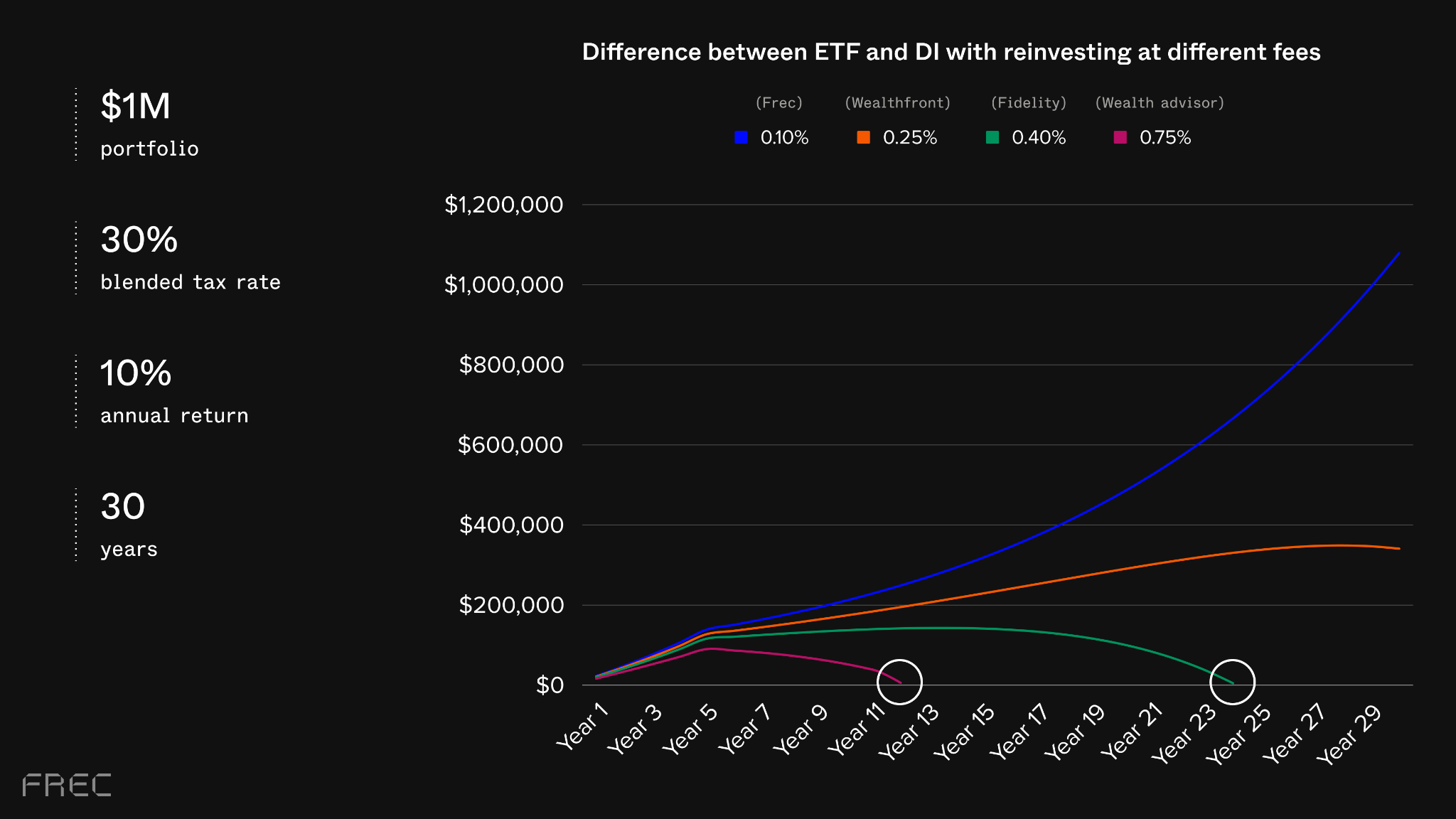

Many investors can and do hold ETFs and direct indices at the same time. The direct indexing portion of their portfolio will offer additional tax benefits that investing in ETFs does not. The ETF holdings may be maintained for a variety of reasons, including a low legacy cost basis, low fees, or a desire for exposure to a specific ETF’s set of holdings. It is important to watch the fee burden on the direct index closely; high fees can cancel out much or all of the tax benefits of direct indexing.

Direct Indexing vs. Custom Indexing

Direct indexing can be customized to fit an investor’s personal preferences and convictions. This is called custom indexing. While traditional direct indexing involves mirroring an index as closely as possible, custom indexing means creating a custom index—which may or may not be similar to an existing one.

Traditionally, custom indexing has only been offered by wealth advisors with associated high fees. Due to its nature, it also is more difficult to track against a benchmark. However, many newer direct indexing platforms allow investors to customize their indices. This option preserves the core value proposition of tax-loss harvesting.

Direct Indexing vs. Using a Financial Advisor

Wealth advisors have been using direct indexing for decades. In fact, numerous providers cater to financial advisors who then package the strategy for their end clients.

However, this approach often comes with high fees and a lack of visibility into the trades. The associated costs can erode the potential tax benefits and overall returns, making it less attractive compared to more modern, automated direct indexing platforms that offer greater transparency and lower fees.

Working with a wealth manager is not a requirement; it can be executed equally well with or without an advisor.

6 Potential Drawbacks of Direct Indexing

While direct indexing offers a variety of significant benefits, there are important trade offs to consider, and some people for whom the benefits will be relatively limited:

Investors who do not have (and don’t plan on having) significant capital gains. The tax deductions from tax-loss harvesting are primarily useful to reduce the tax bill on capital gains. Investors who do not envision any significant capital gains now or in the future, or who already have a plan to offset those taxes in other ways, will see fewer benefits.

Investors who want to invest in actively managed funds. Direct indexing is not ideal for indices that have a high turnover of stocks, an equal market-cap weighted index, or an actively managed ETF. Direct indexing works best with indices that have relatively stable compositions.

Non-taxable retirement account funds. Investors may still use direct indexing to customize the holdings of their 401(k) accounts, but the tax protections of these accounts make the tax benefits of direct indexing irrelevant for these funds.

Tax deferral, not tax elimination. When investors harvest losses within their direct index accounts, they are effectively reducing the cost basis of these accounts. When and if they liquidate these accounts, any losses they have harvested along the way will be recaptured in their long-term capital gains. There remains significant value in delaying taxes for years or decades, but investors should still remain aware of this dynamic. Should an investor leave a direct index account to heirs or donate it to charity, this tax loss “recapture” can be avoided entirely.

Increased complexity in moving funds. Just like with simple ETF holdings, investors can move their direct index assets between brokers. However, in the case of direct indices, the receiving broker may not be able to continue to rebalance holdings and capture losses dynamically. Many traditional brokers will simply hold those assets as a collection of several hundred “static” positions.

Tax benefits diminish over time. Harvested losses are frontloaded, which is expected since the cost basis of the purchased assets are most similar to their market prices immediately after purchase. This is why fees are important. Investors should avoid paying high fees for a portfolio that no longer provides significant tax-loss harvesting opportunities. Continually contributing new assets to a direct indexing portfolio will refresh its tax loss harvesting potential.

FAQ

-

You can stop direct indexing at any time by transferring your assets to another brokerage. If you don’t want to hold as many individual stocks, you can always sell out of positions with smaller market caps and offset any potential capital gains from those sales with tax losses you’ve harvested.

For example, by the end of June 2024, the top 20 stocks in the S&P 500 made up 45% of the index. You could keep just a few of these top stocks, still capture most of the index's value, reduce the number of stocks you own, and lower your potential capital gains. This strategy varies depending on the index you invest in.

-

Direct indexing can be a good way to reduce your tax burden if you have a concentrated stock position. First, you’re able to remove that concentrated position from your index if it’s part of it, decreasing further concentration while still investing in the index.

You can also slowly sell out of your concentrated position and invest into direct indexing. The tax losses from these sales can offset any capital gains, helping to reduce your tax burden. You could start by selling stocks with a higher cost basis to lower your initial capital gains tax. Over time, the losses in your direct indexing portfolio can help offset larger future capital gains. This approach allows you to gradually reduce your concentrated stock position while managing your tax liability.

-

No. Even though a direct indexing provider makes hundreds of trades on your behalf to save you on taxes, the filing process is simple, provided that your tax loss broker provides the appropriate tax documents. With Frec, investors receive a 1099 consolidated tax form every February for the previous tax year. A tax summary on page two of the form shows your total net short-term and long-term gains or losses. These consolidated numbers can be entered into your tax return.

Bottom Line: Is Direct Indexing Worth It?

Whether direct indexing is worth it depends on each investor’s specific situation. For investors who anticipate future capital gains and prefer a passive, low-cost index-tracking strategy, transitioning to direct indexing can be beneficial. This strategy delivers similar pre-tax performance as ETFs and mutual funds tracking the same index while adding a significant tax efficiency tailwind.

However, when fees reach a certain level, the potential tax benefits compared to an ETF diminish. For an easy and cost-effective way to get started, continue reading to learn more about Frec.

With Frec, investors track the performance of the benchmark ETF while accumulating tax losses. On December 5, 2023, we deposited $50,000 into our direct index strategy tracking the S&P 500 index, as shown in this live account. The benchmark shows the performance of the largest ETF tracking the same index, SPY. Since funding, the portfolio has performed both above and below SPY but remained within an average of 0.13% difference while accumulating $1,863.45 in tax losses. This account also takes into account Frec’s annual 0.10% fee and SPY’s 0.09% expense ratio.

About Frec Direct Indexing

Frec’s mission is to give everyone access to sophisticated investment tools for building long-term wealth. Many advanced wealth creation strategies, such as direct indexing, are now ready for mass adoption due to technological advances in financial tooling over the past decade. Our goal is to lead the way in making direct indexing intuitive and accessible.

Founded in 2021 and based in San Francisco, Frec’s platform is built from the ground up with efficiency and technology at its core. This enables indexing at a lower price than others—starting at just a 0.10% AUM fee. At the same time, the user experience is simple and transparent. We exclude unnecessary complexities and overhead, making direct indexing an attractive addition to any client’s portfolio.

Frec Securities is an SEC-registered broker dealer and member of FINRA and SIPC, while Frec Advisers is an SEC-registered investment adviser and fiduciary. Your stocks are held in your name at Apex Clearing, which custodies over $110 billion for some of the largest investment platforms—meaning you always have access to it.

Why invest in ETFs when you can achieve index-like performance with added tax savings and customization at a similar cost?

Check out Frec’s live demo here.

Schedule a call here.

Get started here.

About Long Angle

Long Angle is a private community of high-net-worth investors who leverage their collective expertise and scale to access and underwrite some of the world's best alternative asset investments. Asset classes range from private equity, search funds, and private credit to secondaries, real estate, and venture capital.

Long Angle is a high-net-worth peer community, not a wealth manager. Members independently make their investment decisions on a deal-by-deal basis. They are treated as partners in every investment, with full transparency regarding the investment team's diligence and underwriting processes. All members receive equal access to negotiated fee discounts.

Membership is free but requires an interview with a current community member, as well as validation of investable assets. Apply Now »

This document describes direct indexing and its benefits and drawbacks at the time of writing (08/01/2024); details may differ in the future. It may be amended at any time to reflect new findings, improve readability, or correct inaccuracies. This document is for informational purposes only and is not intended as tax or investment advice. “Frec” refers to Frec Markets, Inc. and its wholly owned subsidiaries, Frec Advisers LLC and Frec Securities LLC. Frec does not provide legal or tax advice and does not assume any liability for the tax consequences of any client transaction. Clients should consult with their personal tax advisors regarding their particular circumstances. Clients and their personal tax advisors are responsible for how the transactions conducted in an account are reported to the IRS or any other taxing authority on the investor's personal tax returns. Frec assumes no responsibility for tax consequences to any investor on any transactions. The effectiveness of Frec's tax-loss harvesting strategy to reduce tax liability of the client will depend on the client's entire tax and investment profile, including purchases and dispositions in a client's (or client's spouse's) account outside of Frec, the type of investments (e.g., taxable or nontaxable), or holding period (e.g., short-term or long-term). The performance of the new securities purchased through the tax-loss harvesting service may be better or worse than the performance of the securities that are sold for tax-loss harvesting purposes.

Direct index strategies and treasury advisory services are provided by Frec Advisers LLC (“Frec Advisers”), an SEC-registered investment adviser. See Frec Advisers Form ADV Part IIA for additional information, including details on the US direct indexing strategies. Frec Advisers does not guarantee that the results of its advice, recommendations, or the objectives of its direct index or cash management strategies will be achieved. We make no assurance that the investment process will consistently lead to successful investing. Before you invest, you should carefully review and consider your investment objectives as well as the risks, charges, and expenses of the underlying securities. There is a $20,000 account minimum per index required to participate in Frec’s direct indexing strategies.

Investing involves risk, including the risk of loss. Brokerage products and services are offered by Frec Securities LLC (“Frec Securities”), an SEC registered broker-dealer, member FINRA/SIPC.